Research Terminal - Sales Flow

How we expect traders will use our tools, resulting in higher engagement and trading volumes

New Traders

Typical characteristics of a New Trader

Little experience, want inspiration, lacking ideas, trust expert opinion, want high conviction.

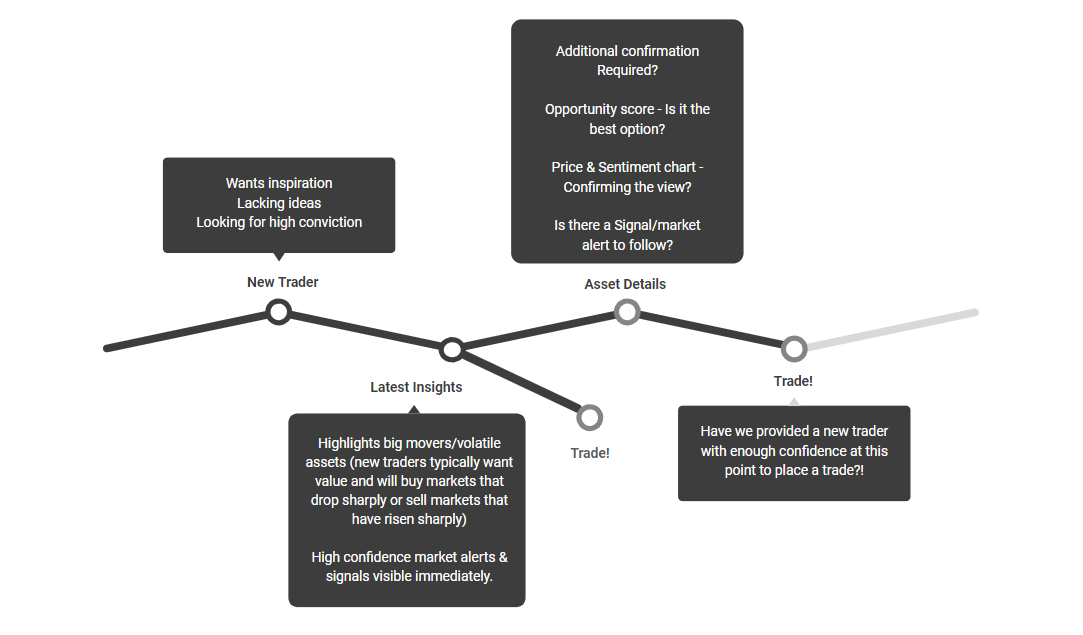

Below is an image of the expected journey a new trader will take using our tools.

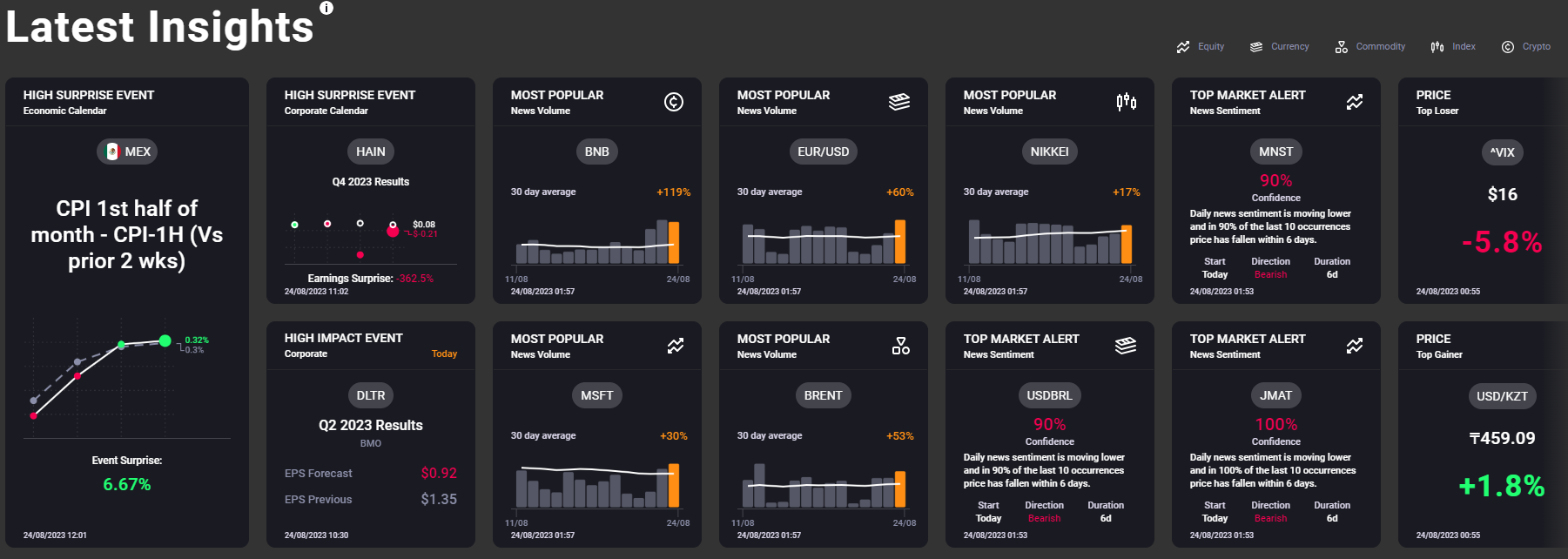

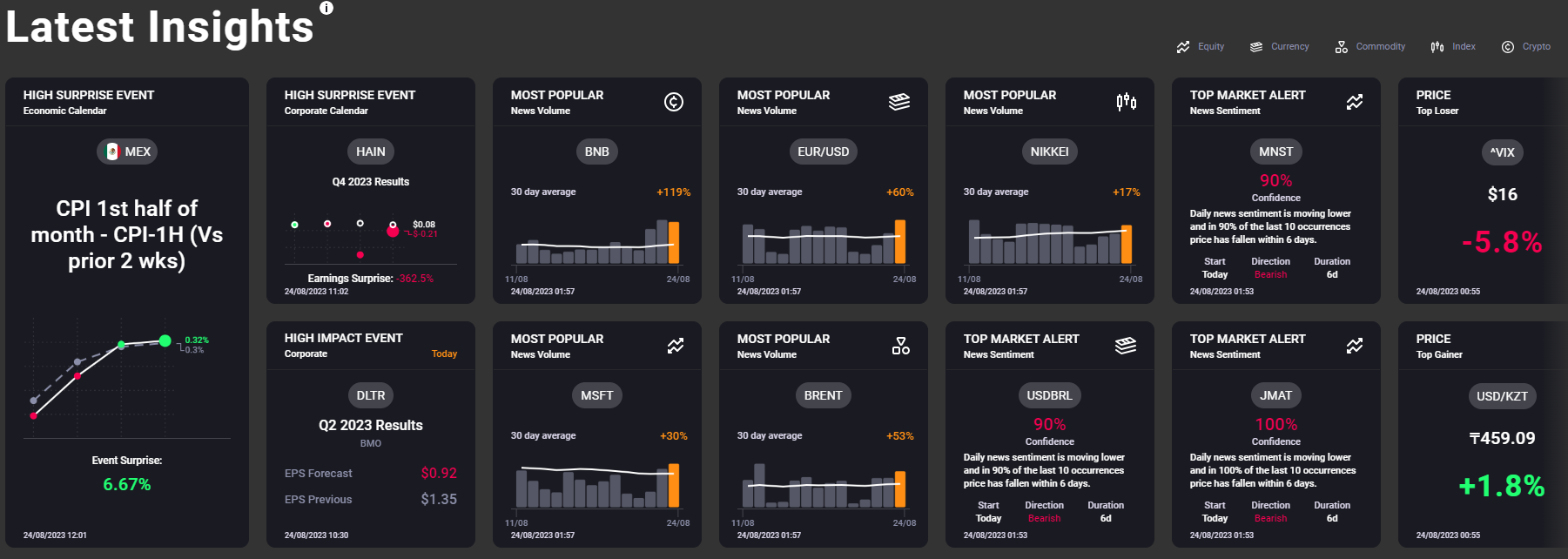

The first area a new trader will see is the 'Latest Insights' section.

- Highlights big movers/volatile assets (new traders typically want value and will buy markets that drop sharply or sell markets that have risen sharply)

- High confidence market alerts & signals visible immediately.

- Significant market events, both corporate and economic are highlighted, typically these events create high levels of volatility.

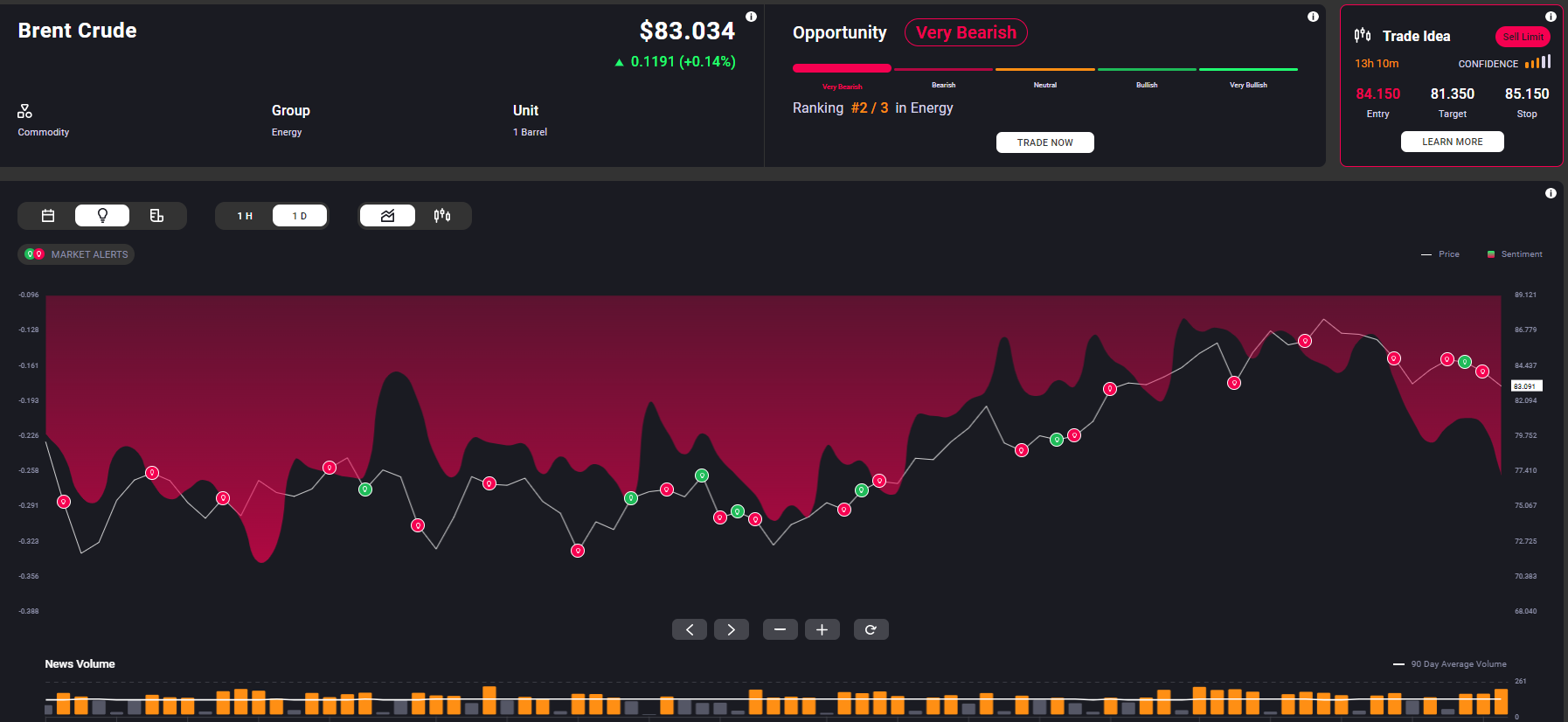

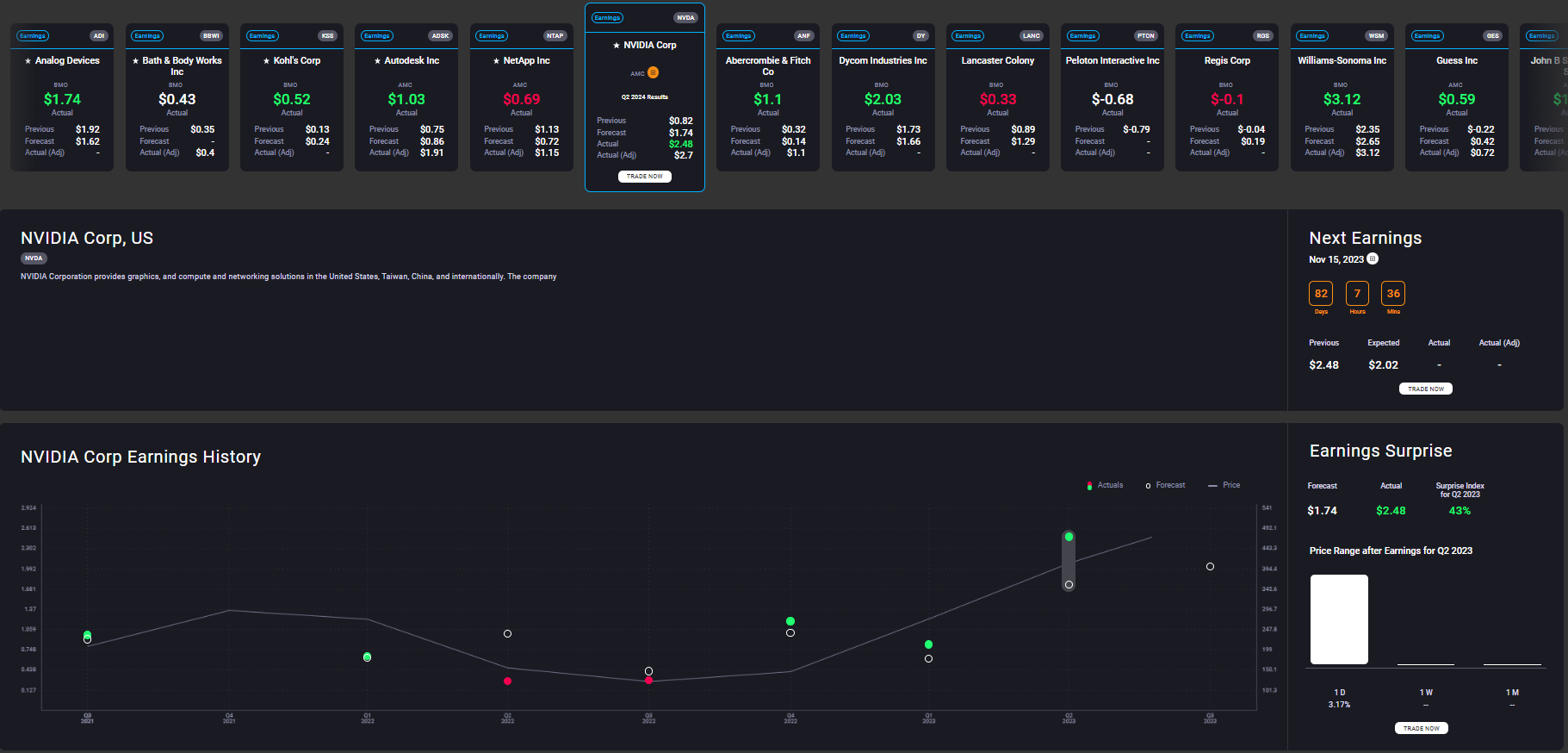

If additional confirmation or alternative information is required on the asset identified, then users will be routed through to out 'Asset Details' section.

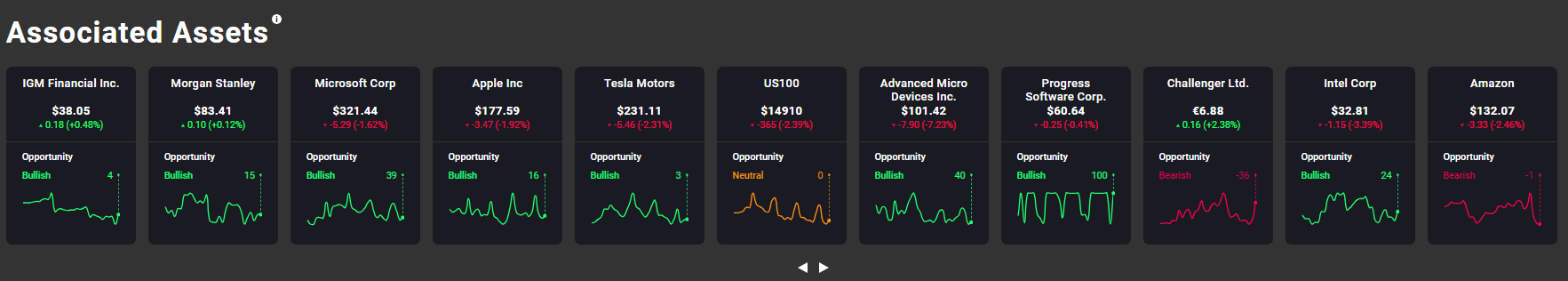

- Each asset we cover has an 'Opportunity score'. Here traders can determine if this is the best option for them based on their view. Either providing confirmation or invalidating their thoughts

- Price & Sentiment chart will be used to confirm the trends on both price and news sentiment.

- Ready made call to actions are available to be utilised. Either direct signals or via our market alerts tool.

At this point it is expected that a new trader would be confident enough to place a trade.

Call to action buttons are placed throughout our terminal and platform integrations to provide seamless access for traders.

Experienced Traders

Typical characteristics of an experienced trader

Likely to have their own thoughts and ideas when it comes to trading. Unlikely to be influenced by opinions. Likely to conduct deeper levels of research.

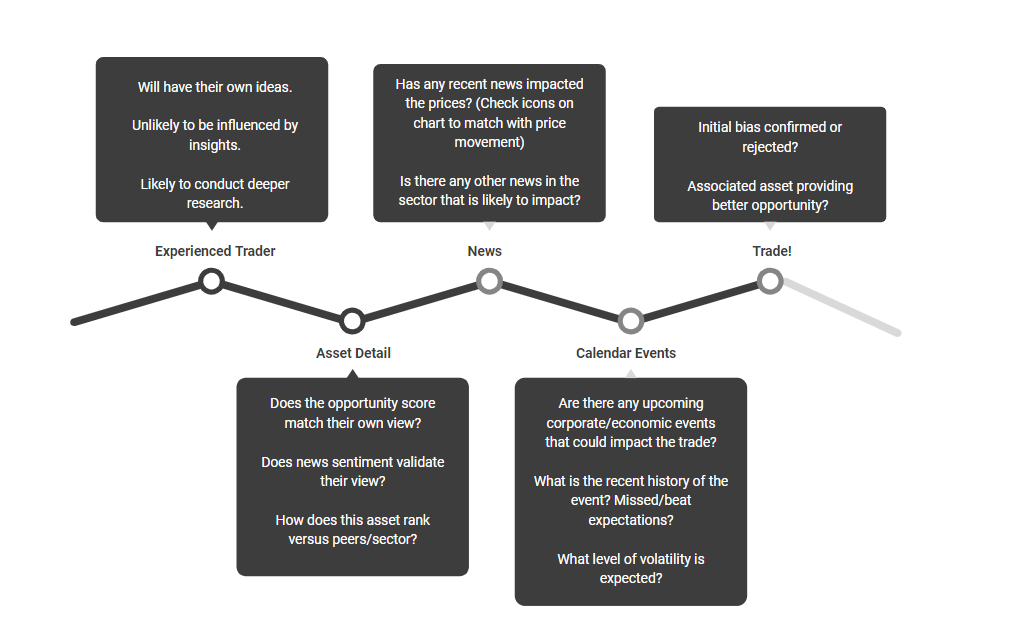

Below is an image of the expected journey an experienced trader will take using our tools.

The first area an experienced trader will see is the 'Latest Insights' section.

They are less likely to be influenced or triggered by this information

An experienced trader is likely to know the asset they are interested in, and therefore will head directly to that section via 'Asset Details'.

- Does the opportunity score match their own view?

- Does news sentiment validate their view?

- How does this asset rank versus peers/sector?

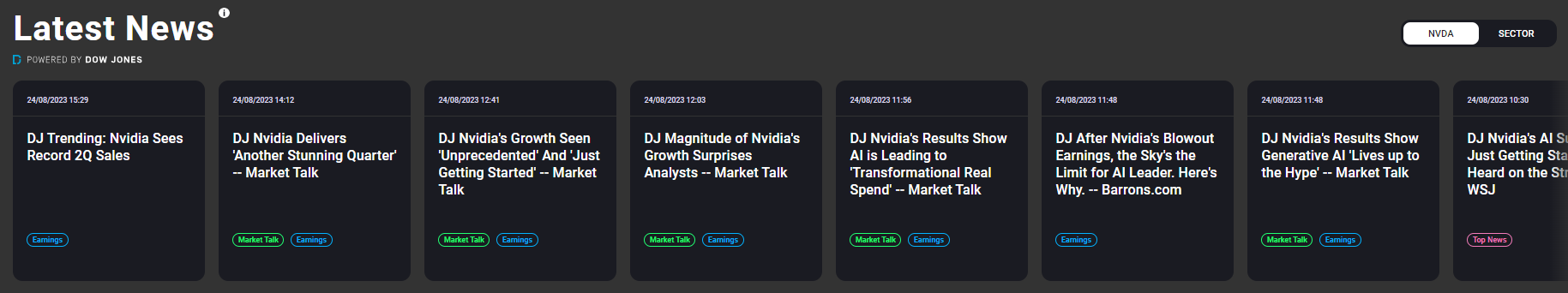

- Has any recent news impacted the prices?

- Is there any other news in the sector that is likely to impact?

- Are there any upcoming corporate/economic events that could impact the trade?

- What is the recent history of the event? Missed/beat expectations?

- What level of volatility is expected?

- Associated asset providing better opportunity?

- Initial bias confirmed or rejected?

At this point it is expected that an experienced trader would be confident enough to place a trade.

Call to action buttons are placed throughout our terminal and platform integrations to provide seamless access for traders.

If you haven't found what you're looking for yet, don't worry! Our team is here to assist you.